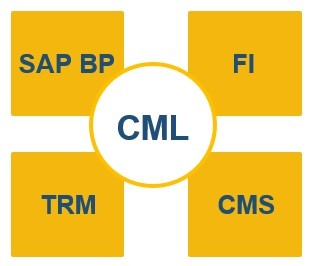

SAP FS-CML Loans Management enables companies to manage both simply structured loans like consumer loans, and complex loans such as mortgage loans.

It is used by many corporations that lend money to their customers or distributors. It has the advantage that it’s an embedded module of SAP FI therefore is fully integrated in SAP’s S/4HANA ERP.

It provides functionality to manage the full loan lifecycle:

- Product Management

- Loan Contract Origination

- Flexible Loan Conditions

- Loan Disbursement

- Position Management

- Cash Flow Disturbances / Loan Prolongation

New Business Process

Loan parties are created as Business Partners and have distinct roles:

- Main Loan Borrower

- Borrower (Additional)

- Authorized Drawer

- Correspondence Recipient

Loan Offers can be created and have different approval steps before a Loan Contract is created. Additionally, Loan Contracts can be fully or partially disbursed during the loan lifecycle.

Position Management Process

Position Management allows for day-to-day business operations:

- Display and Maintenance of Loan master data

- Contract Changes

- Posting to FI accounting based on the loan schedules

- Accruals and Deferrals

- Valuation

- Business Operations

Cash Flow Disturbance Process

During the loan lifecycle the planned Cash Flows can be affected in the following ways:

- Dunning of Open Items

- Interest on Arrears calculation

- Business Operations – manual non-scheduled transactions on individual loans

- Write-offs and Waivers

- Value adjustments (foreign currency, variable rates, etc.)

SAP CML Features

Different Product Types can be maintained in SAP CLM. This allows for the creation of complex Loan Schedules.

Loan Schedules are modeled with the use of Condition Items, which allow for a clear understating and control of calculations.

Loan Lifecycle – Contract

Contract Header

- Company Code

- Product Type

- Status

Contract Master Data

- Loan Type

- Loan Class

- Posting System

- Discretionary Accruals / Deferrals

Loan Lifecycle – Conditions

Condition Header:

- Commitment Capital

- Term Start / Fixed From

- Fixed until / Term End

Condition Items:

- Condition (Interest, Repayment, Fee)

Loan Lifecycle – Condition Concept

Loan Lifecycle – Cash Flow

Account Determination Overview

Planned schedule items are posted to FI Accounting when they are due.

Each Flow Type is posted to FI G/L or Customer accounts depending on an account determination.

Each flow type will post to debit and credit symbols. These symbols are resolved to specific customer of G/L accounts based on the account determination customizing.

Release Procedures

A multiple-level Release Procedure can be defined for the main functions of Loans Management:

- Loan Disbursement

- Loan Master Data Changes

- Charges

- Payoffs

- Waivers/Write-offs

- Reversals

Different Approvers/Agents can be assigned to each release step, and work items can be processed in the Business Workplace Inbox.

For more information, contact us by filling the form below and request a free demo.